by M. Nahum Daniels

If you’ve been wondering about the book I wrote, RETIRE RESET!, we are publishing some excerpts right here on our blog so that you can learn more. Along the way, you will learn why our firm, Integrated Retirement Advisors, was founded: we’re on a mission to help people with retirement!

Here are some excerpts from Chapter 3.

Chapter 3: TIME IS MONEY

Retirement clock management begins with the very first questions posed in the planning process: “When can I (afford to) retire? Can it be sooner, does it have to wait until later or will it be never? And by the way, how long should I expect my retirement to last?”

When a husband and wife aged 65 first visit with me and they’re in reasonably good health, I have to inform them that, statistically, one member of the pair (usually the female) has a 50% chance of making it to age 94 and a 25% chance of making it all the way to age 98. And if she makes it to 98, she has a 50% chance of making it all the way to triple digits, because actuarial science informs us that the longer we live, the better our odds of further survival.

When urging clients to get proactive about their long-term financial planning, I often relate the remarkable story of Dr. Ingeborg Rapoport. It brings home not only the indomitable power of the human spirit, but also the truly amazing advances in human life expectancy that have been achieved over the last century—and continue to be made with increasing velocity.

Dr. Rapoport had already been retired for thirty years when Hamburg University authorities finally gave her a chance to complete her doctoral degree—but only after following all the rules. She would have to stand for an oral exam, questioned face to face by a panel of academics, to defend her original dissertation on diphtheria. The dissertation had been well received when she first submitted it at the tender age of 25, but she was blocked by the Nazi regime from completing the process because her mother was Jewish. Although she went on to enjoy a professional career in neonatal medicine she always felt unfairly deprived and, after 77 years, wanted to right what she felt was an injustice.

Now nearly blind, it was only with the help of friends that she was able to catch up on developments in diphtheria studies during the intervening decades. Dr. Rapoport passed her exams with no age-based indulgences and was finally awarded her degree in 2015, becoming the oldest person ever to be awarded a doctorate, according to Guinness World Records. She was 102.

And that’s the point: Underlying successful retirement planning at any age today is an appreciation of contemporary developments in longevity. No matter your starting point, if you’re in reasonably good health you’re advised to play the long game.

Most retirees are naively complacent about longevity risk

The wealthier and better educated the individual, the more life expectancy improves. If, as frequently happens, one spouse turns out to be 10 years younger when the primary earner reaches full retirement, then to be prudent we should be planning for a 45-year joint cash flow—ideally adjusted for inflation to preserve its purchasing power.

Portfolio design follows on from that core purpose. Thus, our first objective is to figure out how to guarantee a lifelong cash flow to replace previously earned income in amounts sufficient to match your expenses.

In an inflationary environment, time reduces money’s worth and therefore accelerates its use. In a deflationary environment, time enhances money’s worth and defers its use to another day when it will buy more. The longer the time horizon in which these forces play out, the more pronounced the antagonistic outcomes. Thirty years of inflation at 3% results in a 60% loss of buying power; three decades of compounding 3% interest can produce a 140% increase in buying power. That’s a 200% spread, making this a battle that is absolutely worth fighting.

Sequence of returns risk

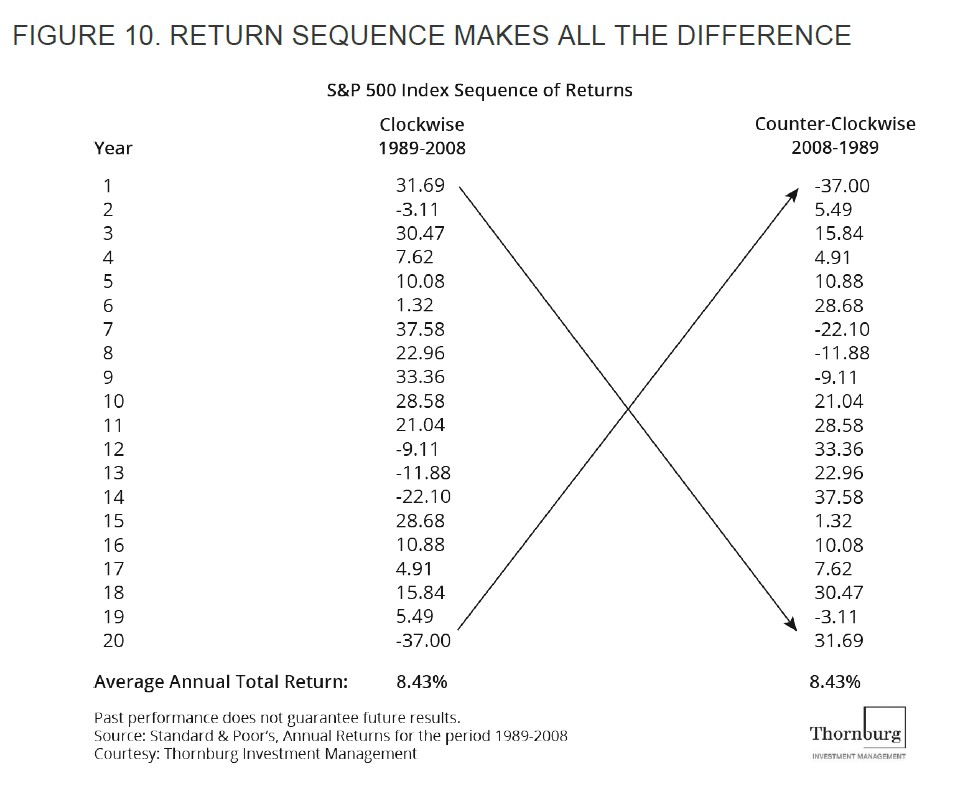

If you think that an “average return rate” tells you anything about retirement investing, you haven’t seen the effect that sequence of returns can have on a portfolio.

Figure 10 illustrates S&P 500 total returns generated over the 20-year period from 1989-2008. The average return over the period was 8.43%. The first thing to notice is that no single year actually produced a return equal to the average; returns ranged from losses as great as -37% to gains as high as +38%. If we reverse the sequence, the average annual return remains the same.

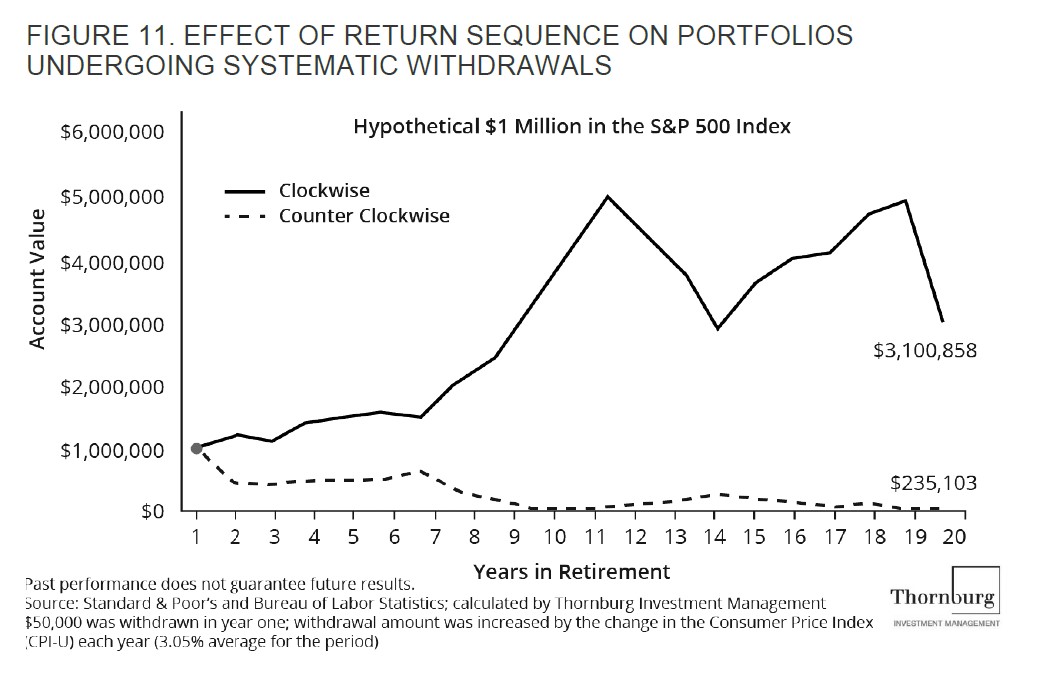

Figure 11 shows what happens when a retiree starts pulling money out of their portfolio at a rate of 5% per year for retirement income. The clockwise sequence (based on S&P 500 from 1989-2008 from Figure 10) left a theoretical retiree with a $3.1 million asset pool at the end of twenty years available for spend-down over the next 20; the counter-clockwise sequence would have left the same retiree with a miniscule $235,000 that would have to be stretched over a decade or two!

Chapter 3 Takeaways

- Retirement planning starts with assuring that your nest egg (with or without inputs from other income sources) serves as a personal pension guaranteeing you the paychecks you’ll need for 30-40 years after you stop working.

- As an investor, you need to understand that time is of the essence and that playing the long game means hedging against numerous long-term cyclical risks decades in advance of their possible impact.

- Once you begin to spend down, retirement success depends more upon the sequence of returns you earn than the annual magnitude of those returns.

- To make your nest egg last for the long run, best practice is to focus on avoiding sharp losses rather than seeking high returns.

- True compounding will yield a more predictable outcome than the generation of random market returns that can offset each other, reduce the net result to zero (or less) and waste your precious time.

###

If you would like to discuss your personal retirement situation, please don’t hesitate to call our firm, Integrated Retirement Advisors, at (203) 322-9122.

If you would like to read RETIRE RESET!, it is available on Amazon at this link: https://amzn.to/2FtIxuM