The Problem:

Retiring Comfortably is Getting Harder

- Making money last for 30 years or more is not easy for individual investors or professional money managers.

- In this age of financial repression, it’s simply hard to make money on your money, no matter how much you have.

- Then there’s volatility and bad timing; losses can knock any portfolio for a loop and send the plan it supports reeling.

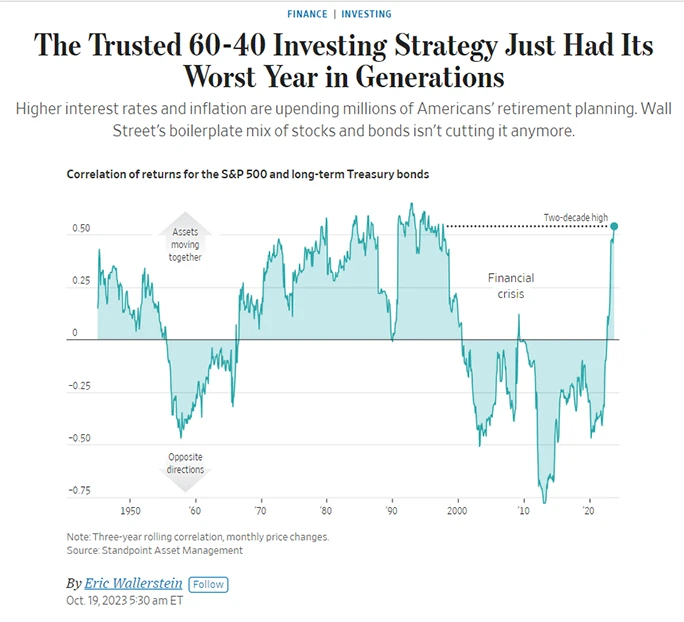

- The years 2000-2009, for example, proved to be a “lost decade” when Wall Street’s signature strategy, the “60/40 portfolio”, failed.

- Considering the current state of interest rates, equity markets, national debt, and other indicators, some valuation measures warn of possible danger ahead.

- We believe retirement investors should consider retooling.

Solution

By blending securities and insurance to each client's measure, the Integrated PortfolioTM seeks to offer a complete retirement solution -- out-performing BlackRocks's expected 60/40 returns to pace real inflation while reducing volatility, avoiding market losses, deferring and minimizing taxes, protecting assets, avoiding probate, positioning wealth for multi-generational transfer, and guaranteeing longevity-hedged retirement income

The Components

Holistic Planning

Realistically matching increasing lifelong income needs to all available income sources—guaranteed and otherwise—to project annual sufficiency, surplus or deficit. Includes contingencies in a worst-case scenario. The plan is your GPS, enabling you to tell if you’re spending too much or too little, keeping you on track and mapping needed tactical adjustment along the way.

Social Security Timing

A lynchpin of your retirement planning, determining when to claim the benefits you’ve earned is a complex decision that depends on your marital and financial circumstances and retirement objectives. The SS Administration is not legally authorized to provide this personalized analysis, which should recognize the possibility of a 24% reduction in benefits expected to take effect as early as 2027 but currently no later than 2034.

Protected Investing

We believe it's time to re-tool your retirement portfolio focused on your "safety net," using the latest risk-control strategies designed to mitigate or totally avoid market losses while still enabling you to participate in positive outcomes.

Income Optimization

Optimizing income means deriving the lifetime cash flow you need from the least amount of capital required. Rather than using low-yielding bonds, we employ more efficient alternatives that not only generate better income; they're also built to help you keep up with inflation.

Income Tax Planning

Income taxation is a dominant force in personal finance. Staying ahead of systemic changes and minimizing their adverse effects is essential for both wealth accumulation during the runup to retirement and wealth de-cumulation during retirement itself. Rooted in formal training, and in collaboration with your advisory team, our approach seeks to shelter you from the erosive effects of income and capital gains taxation during both phases of your financial life.

Contingency Hedging

Life is filled with unexpected events—positive and negative—that trigger economic consequences. In retirement planning, some negative probabilities can be hedged by off-loading their attendant risks to insurers or reserving capital to cover them. It’s vital to identify them and their potential impacts in advance to choose the best way to get a measure of control over their impacts on your retirement outcome.

Your Wealth Advisor

About Nahum Daniels

As a wealth advisor to a generation facing unprecedented challenges, Nahum Daniels seeks to transmit the practical knowledge today’s retirees need to pursue a more confident financial future.

Independent and experienced, Nahum has traveled the world and offers a global perspective. Serving mature investors for over 35 years, he is most effective working with people who are lifelong learners capable of thinking independently and acting decisively.

If you are open to new ideas that may benefit you and your family, he invites you to take the next step.

Best-Selling Book

Retire Reset!

Written to inform retirees, pre-retirees, and their advisors, this book unveils a whole new approach to retirement investing that challenges conventional thinking about stocks and bonds to offer a timely alternative. Focused on the financial dynamics of retirement, Nahum provides an eye-opening perspective on a century of our economic history as well as our pending economic prospects.

Deftly translating into actionable advice some of the latest findings released by America’s leading retirement institutes and university researchers, he puts a human face on the retirement planning process by offering personal examples drawn from a 35-year long career.